Bessent accuses Wall Street Journal of taking ‘CCP dictation’ on Trump trade war story

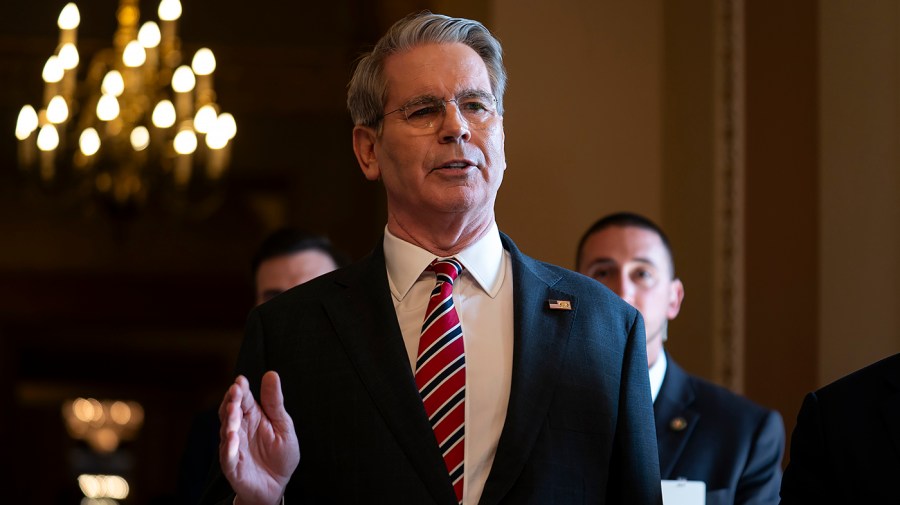

Treasury Secretary Scott Bessent blasted The Wall Street Journal over its coverage of U.S.-China trade relations and accused the newspaper of shilling for China.

“I think this narrative … just a terrible Wall Street Journal article today, just complete … they’re taking CCP [Chinese Communist Party] dictation,” Bessent said shaking his head at a CNBC investor event Wednesday. “President Trump likes a high stock market, but he — like me — believes the high stock market is a result of good policy.”

Bessent was referencing a story the Journal published Wednesday detailing how China was, as the Rupert Murdoch-owned newspaper put it, “playing hardball” with Trump. The Journal reported the Chinese government believes the U.S. president would “fold” on tariffs that would hurt U.S. markets.

“If we have to make strong measures against the Chinese, it won’t be because of the stock market,” he said. “We won’t negotiate because the stock market is going down, we negotiate because we are doing what is best economically for the U.S.”

Trump and his allies have regularly attacked the Journal over its coverage of him, and the president sued the newspaper earlier this year for defamation in connection with its reporting on his alleged ties to Jeffrey Epstein.

Bessent, a top Trump ally, has in recent days criticized mainstream media coverage of the government shutdown and accused news outlets of blaming Republicans for the widespread financial uncertainty the congressional stalemate has caused.

His comments come after a wild week for financial markets, which been volatile in the wake of renewed trade tensions between the U.S. and China.

Trump announced last week he would impose tariffs of 100 percent on all Chinese imports by Nov. 1 in response to new restrictions from Beijing on rare earths exports.

Rare earths are minerals used in a wide range of valuable technologies, including semiconductor chips, electric vehicles and military aircraft. China controls roughly 70 percent of the world’s supply of rare earths, giving the country significant leverage over the global market.

Bessent said Wednesday the U.S. would look into building its own stockpile of rare earths and taking stakes in domestic companies responsible for mining such materials