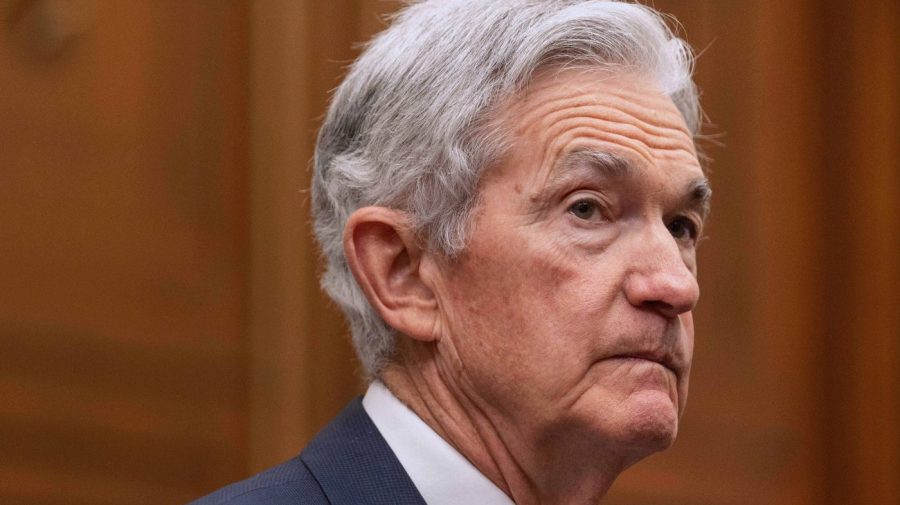

Trump should not fire Jay Powell — at least, not yet

President Trump should not fire Jay Powell.

The Fed chairman is likely to hold rates steady again at next week’s meeting, which is almost certainly a mistake. But if unemployment begins to creep higher and the economy softens, Trump can then blame Powell. His own appointed Fed leader can become a useful fall guy.

Speculation about Trump firing Powell is ongoing, despite repeated denials from the White House. He stoked those concerns again yesterday by visiting the Fed’s headquarters, the first time in 20 years a president has made that trek. Trump went purportedly to inspect what has become known as the “Taj Mahal on the Mall,” aka the $700 million-over-budget $2.5 billion remodeling project of the Fed’s building. Russell Vought accompanied Trump; the head of the Office of Management and Budget has calculated that the cost of the Fed’s elaborate construction is about the same as the price originally paid (adjusted for inflation) for France’s Palace of Versailles.

Meanwhile, Rep. Anna Paulina Luna (R-Fla.) referred Powell to the Department of Justice for criminal charges, accusing him of two specific instances of lying under oath before a Senate committee about the particulars of that headquarters modernization.

To be clear, notoriously spendthrift D.C. legislators have not suddenly found religion about cost overruns on federal projects. Scrutiny of the Fed building, and accusations that Powell committed perjury, are meant to allow Trump to dump the Fed chair, who can only be fired for cause.

The real story is, of course, the economy. And there are three reasons Powell should cut rates.

First, Powell has said he is holding off on rate cuts because Trump’s tariffs regime is expected to cause some increase in inflation. But in a recent speech, Fed Governor Chris Waller argued that tariffs are “one-off increases in the price level and do not cause inflation beyond a temporary surge.” That is, the application of a 10 percent tariff, for instance, will possibly cause a one-time bounce in prices but (barring any other influences) not create ongoing inflation. Waller also says, “Standard central banking practice is to ‘look through’ such price-level effects as long as inflation expectations are anchored, which they are.”

That is true. Early in the tariff excitement, consumers became worried about the possible impact of tariffs on prices, even as inflation was moderating. The media cranked out alarming projections of the damage tariffs could do, feeding the concerns.

The central bank’s monthly Survey of Consumer Expectations showed respondents in March and April expecting inflation to bounce up to 3.6 percent in the next year; most recently that dropped to 3 percent, in line with readings from January.

Consumers have been calmed by consistently better than expected inflation reports. Lower energy costs, in particular, drove the consumer price index down from 3 percent in January to 2.3 percent in April, calming nerves. More recently that gauge of inflation has increased to 2.7 percent, but that is still lower than last year, when it was 3 percent.

Waller said he has been watching reports on high-frequency price changes — that is, real-time price changes from big retailers’ online stores. He concludes that prices on imports are slightly higher while domestic goods have not seen upward adjustments. Not surprisingly, prices on imported Chinese goods have been jacked up the most. But, overall, the impact of tariffs has been minimal so far.

Second, there are cracks in the jobs picture, which is meant to be the other focus of the Fed. Small businesses show some modest increased interest in hiring, which is good news, but Americans are becoming less optimistic about their job prospects. According to The Kobeissi Letter, “The index tracking Americans’ expectations for unemployment over the next 12 months fell to 58 points in July, the third-lowest since 2008. This level of pessimism also aligns with readings seen during the 2001 and 1990 recessions.” Job postings on Indeed, an online recruitment site, have been dropping, and there has been a modest increase in continuing unemployment claims, indicating people are having a harder time finding work.

A report just out from The Bridge Chronicle reveals the tech industry has laid off more than 100,000 workers this year, with Intel and Microsoft leading the pack. Some of the firings stem from financial concerns, but AI is also powering a slimming down of white-collar jobs. Tech is not alone — across industries, CEOs are spending tens of millions of dollars to implement AI, with hopes of recouping those expenditures via reduced payrolls.

Is Jay Powell on top of these trends? There has been precious little in his periodic reports to indicate the Fed chair is taking AI-impacted job losses into account. If Powell is basing monetary policy on what he imagines the inflationary impact of tariffs will be, should he not also be looking forward and folding AI effects into his job projections?

Third, cutting rates would help the housing market, and young families trying to buy a home. Existing home sales recently dropped to a nine-month low, but prices continued to rise in spite of high mortgage rates.

Trump accuses Powell of playing politics. When he orchestrated a jumbo 50-basis-point rate cut last September, it seemed likely to boost the economy — just in time for Kamala Harris’s campaign. Today, with inflation numbers at similar levels and the jobs market showing signs of weakening, Powell is using the specter of tariff-caused inflation to justify inaction.

That will likely prove to be a mistake. But for Powell, the upcoming rate decision is a lose-lose proposition. If he persuades the board to lower rates, he will be accused of pandering to a domineering president, relinquishing the Fed’s independence. If he sticks with rates that are likely considerably above the neutral rate, and the economy starts to slide, he will be blamed.

Whatever path he and the board choose, Trump will use his decision as proof that “Too-Late” Powell, as he calls him, has messed up again.

Liz Peek is a former partner of major bracket Wall Street firm Wertheim and Company.