China has the US over a barrel in the rare earths market — Trump is fighting back

While the media focus obsessively on the future of Fed Chairman Jay Powell, they all but ignore a major breakthrough engineered by the Trump administration that will ultimately reset our relations with China and free the U.S. from Beijing’s blackmail.

The Biden presidency was pockmarked by sporadic kowtowing to China, as when he allowed a spy balloon to sail unimpeded over U.S. military installations; dismantled President Trump’s “China Initiative,” meant to counter Beijing’s espionage and intellectual property theft in U.S.; and failed to impose secondary sanctions on the country most enabling Russia’s war against Ukraine.

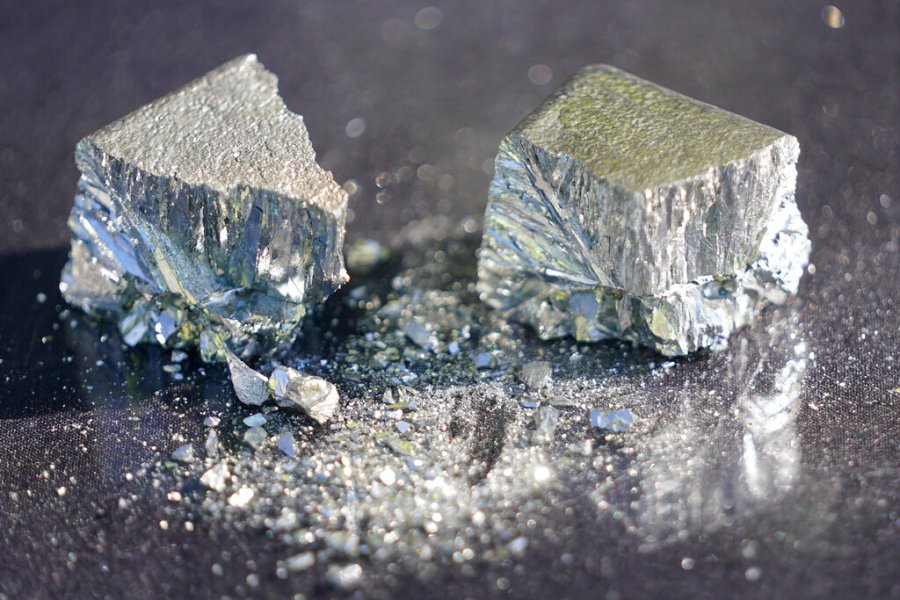

Why was Biden’s White House so timid? Some speculated that the Biden family was worried China might reveal unsavory secrets about their business activities in the country. Perhaps, but they also knew that Beijing held U.S. national security in a death grip. At any moment, the Chinese Communist Party could withhold critical rare earths from our defense and electronics industries. Without the essential magnets produced by those elements, U.S. production of missile guidance systems, semiconductors and more pedestrian products like MRI scanners, cellphones and Teslas grinds to a halt.

Fast-forward to Trump moving to punish China for its illegal trade practices and President Xi Jinping playing his get-out-of-jail-free card, countering Trump’s damaging tariffs by blocking exports of seven medium and heavy rare earth elements. The move caused the U.S. to stand down, but it also alerted the nation once again that Beijing’s smart and dogged effort to corner the world’s supply of rare earths has given China a potent weapon.

It isn’t the first time China has used its dominance of rare earths strategically. In 2010, China retaliated against Japan in a fishing dispute by cutting off rare earths. Trump is, appropriately, moving to free the U.S. from this dangerous noose.

It is not the actual minerals that are in short supply; rare earths are everywhere, including in the U.S., though often found in small quantities that makes extraction costly. China, on the other hand, accounts for 60-70 percent of global rare earth production, and more than 90 percent of heavy rare earths. It has achieved that dominance by its usual practice of flooding the market, undercutting rival mining outfits on price and driving competitors out of business. China has also staked out a commanding position in rare-earths refining.

China accounts for 85-90 percent of rare earths processing, earned the old-fashioned way — by sacrificing its environment. The sifting out of particular elements from mined ore is nasty work, resulting in considerable toxic waste. China, never afraid of despoiling its lakes and rivers, chose to place strategic goals ahead of pollution concerns. Most western nations, including the U.S., would not make such a choice.

Keith Bradsher, Beijing bureau chief for The New York Times, recently described the environmental desecration of lands and lakes surrounding processing facilities in China where “toxic sludge from rare earth processing has been dumped into a four-square-mile artificial lake” and “rare earth mines have poisoned dozens of once-green valleys and left hillsides stripped to barren red clay.” Not only have the mining and processing efforts sickened local populations, they have contaminated water sources and poisoned livestock.

According to Bradsher, public outcry has inspired some clean-up efforts, but protests also resulted in harsh censorship. Mention of some of the worst environmental problems caused by the industry is nowhere to be found.

China paid a high price to capture leadership in rare earths mining and processing, but in the April trade battle, that dominance paid off. Faced with the possibility of industrial mayhem, Trump backed off his most aggressive tariff threats. But then he also set out to solve this problem.

One upshot is an unusual deal in which the Department of Defense will invest $400 million in a once-defunct mining company now called MP Materials in return for a 15 percent equity stake. In addition to the capital infusion, the Trump government is committing to buy MP’s output for the next 10 years at double today’s prevailing price.

According to the Financial Times, Mountain Pass, the predecessor firm to MP Materials, was “the world’s largest producer of rare earths in the 1970s and 80s.” China’s aggressive tactics drove prices lower and shut down its operation in 2002, but our government’s price supports should counter Beijing’s tactics.

MP is not the only company scrambling to claw back America’s participation in rare earth mining. Ramaco Resources recently opened a new coal mine in Wyoming, the first new U.S. mine in 70 years. The CEO claims the company will, in addition to coal, produce over 10 percent of U.S. demand for six of the 17 minerals that constitute “rare earths.” Ramaco claims its reserves of some “heavy earths” are sufficient to supply U.S. demand for more than 100 years.

These measures, even backed by a supportive government, are still inadequate. These mines will still rely heavily on China to process their ore. That stranglehold must also be broken.

Several projects are underway to do just that. MP has over the past year built out refining and separation plants that have apparently cracked the code on environmentally acceptable production, but output remains small — less than 1 percent of China’s total. MP’s prospects received some validation in recent days, when Apple agreed to buy $500 million of “American-made” rare earth magnets from MP over the next four years.

Other companies, like Lynas USA, have entered the race, but they, too, remain small.

The U.S. and other countries will have to replicate China’s processing capabilities to dismantle one of Beijing’s most powerful strategic weapons. That will require an all-out effort to provide cleaner processing techniques and possibly price supports. Some have suggested, in addition, stockpiling a strategic reserve, as we have done with petroleum. That seems smart — like oil, rare earths are critical to our economy.

The Trump White House has made a good start, but the hard work has just begun.

Liz Peek is a former partner of major bracket Wall Street firm Wertheim and Company.